Unlike wine, debt does not get better with age. If you are in too deep and owe too much, you have options and you are not alone. Many people owe too much. In fact, those under 30 make up 14% of insolvent debtors in Ontario.

Millennials are more likely to resort to expensive debt such as Pay Day loans. This just digs you into a deeper hole! Finding a solution to make the collectors go away is your best hope to make the process easier and cost less.

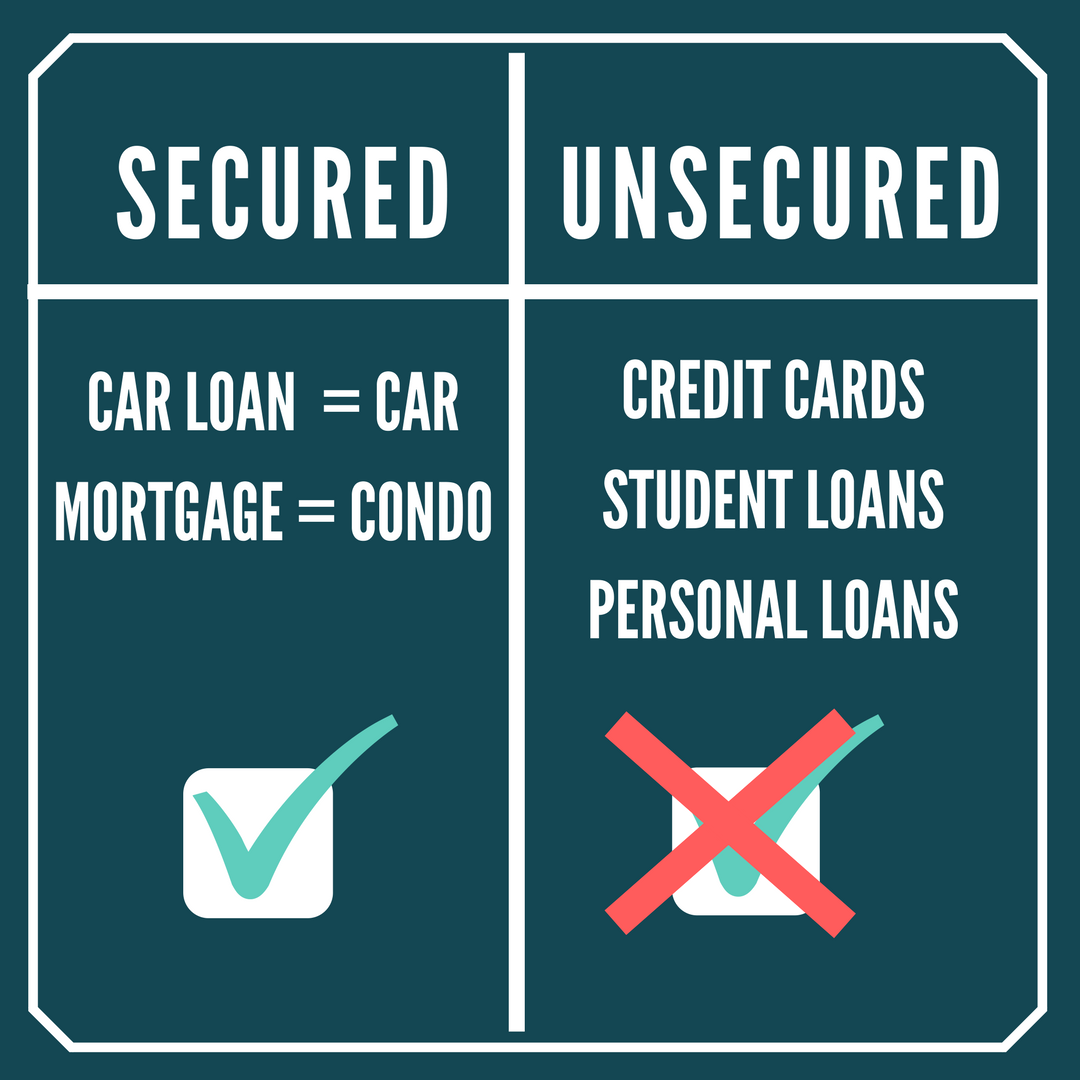

Not all debt is created equal

Some borrowed money is called secured debt and is secured against an asset. Your mortgage is usually secured against your house/condo and your car loan is secured against your car. Your personal loan, student loan, and credit card debt is not secured against your assets.

Why do I care?

If you can’t pay your unsecured debt such as credit card debt, a student loan and a personal loan, then these creditors can’t automatically take your assets.

If you stop your paying off your secured debts, such as a mortgage and car loan, your creditors will eventually take these assets.

If you can pay your mortgage and car loan and you are struggling to pay your unsecured debt, then you should consider options like a consumer proposal. If you can’t pay any of your debts, including making payments on your condo, you may need to consider bankruptcy.

Look at how empty your pockets are and decide what to do

Let’s say you owe a lot of debt. You are bleeding money and very stressed. Take a deep breath.

In life, there are always options.

Your options are consumer proposal, bankruptcy, debt consolidation loan or making a debt management plan. All of these options are compared here

Now a look at consumer proposal and then bankruptcy:

You need some $$$ for a consumer proposal

Let’s say you can pay your mortgage, but you have crazy credit card debt (thanks to those low minimum payments). You should consider a consumer proposal.

How it works is that you go to a trustee in bankruptcy who will file a consumer proposal and make an offer to your creditors to ask them to accept a portion of your unsecured debt.

This means that you have some money to offer or plan on having enough money to pay off your creditors in installments. If your creditors accept your proposal, all collection efforts will be stopped by unsecured creditors.

Remember that proposals only deal with your unsecured debt (like credit card debt).

Luckily, in a consumer proposal, your assets will not be taken. As long as you have money and can keep up your payments, you can keep your condo and car. Phew.

Proposals take a long time and it can be as long as five years until everything is paid.

Once paid, a consumer proposal is noted in your credit report for three years.

Bankruptcy is for when you have no $

Let’s say you can’t pay your mortgage and you have crazy credit card debt. You can’t even pay the minimum payments. You may need to consider bankruptcy.

This sounds like the world’s worst option and the mere thought can bring people to tears. It shouldn’t be so feared. If you don’t have any money and can’t borrow any more, it can be your best option.

In bankruptcy, your secured creditors will have priority to get paid over your unsecured creditors. Some creditors have special rights and rank higher in priority such as a landlord’s rights of distress for rental arrears.

Unfortunately, all of your assets will be seized and liquidated meaning say good-bye to your condo and car.

On the bright side, you can keep that IKEA couch that has been with you since undergrad and your wardrobe. Creditors don’t go after modest furniture, clothing and tools. Also, if you have money in a locked-in-pension, RRSP’s and RRIF’s, you can usually keep these with some exceptions.

Bankruptcy can be a fast process and you can be considered a discharged bankrupt as quickly as nine months after filing. However, bankruptcy will stay with you for six years after being discharged.

Student loans don’t go away:

You should regret that History of Polka Dots class

Student loans should really be in their own category. They are considered unsecured debt but should be categorized as “really annoying unsecured debt that have special rules and take forever to go away.”

Whereas all unsecured debt is forgiven in a consumer proposal and bankruptcy, special treatment is given to student debt.

You have to wait seven years since you attended school to get this debt forgiven.

For example, I finished law school in 2015 so I would have to wait until 2022 until I can apply to have my student loans forgiven (as an insolvent person taking steps to discharge my debt).

If you are a discharged bankrupt that has been out of school for five years after filing, you can apply for a court-ordered discharge of your student loan.

This means I could be a discharged bankrupt with student loans still hanging over my head. Since I graduated in 2015, I could apply to the court in 2020 to forgive my loan.

Even if you file for bankruptcy or do a consumer proposal, you are still stuck with your student loan debt (until 7 years from graduating).

Don’t act like a fool and do nothing

The absolute worst thing you could do is avoid handling this debt fiasco.

This will actually cost you more money and headaches because your creditors will take steps against you costing you more in interest and legal fees.

Act like a fool and you’ll lose your condo/car

If you do nothing and don’t make your payments what will happen is your secured creditors will seize your assets.

There is a six-step process the secured creditor will take. The steps below affect you and these are when the creditor will:

- Demand payment. Contact your creditor/trustee in bankruptcy asap.

- Give you 10 days’ notice of their intention to enforce security (s.244(1) Bankruptcy Insolvency Act). This is when the alarm bells should sound. This is a serious deadline and if you don’t act then they will…

- Obtain possession and control of security. Its too late now. You’re homeless.

Act like a fool and you’ll get your stuff taken away and wages garnished

The unsecured creditor can’t swoop in and take the above steps. But they can (and will) commence an action against you.

Then the unsecured creditor will obtain a judgment of the court and file a writ of execution which will attach to all of your personal and real property.

This means that a sheriff can come to your house and seize such assets needed to pay off your creditors rateably (ss.4(7) Creditors’ Relief Act 2010).

Another option for unsecured creditors (as a creditor with a judgment) is to garnish your wages (Creditors’ Relief Act 2010).

The sun still rises

Once you find a solution you’ll be singing: “I can see clearly now, the [debt] is gone, I can see all obstacles in my way. Gone are the [collectors] that had me blind. It’s gonna be a bright (bright), bright (bright) Sun-Shiny day.”

Once you find a solution you’ll be singing: “I can see clearly now, the [debt] is gone, I can see all obstacles in my way. Gone are the [collectors] that had me blind. It’s gonna be a bright (bright), bright (bright) Sun-Shiny day.”

And here is the song in case you need your spirits lifted.

Thanks for the info! I always pay my mortgage but I am not so diligent with my credit card. I feel a little bit less stressed knowing this.

Great post. I never knew how it all worked, especially student loans. Thanks for explaining.

Kim Gale is a great writer – and lawyer. This blog is so helpful to everyone – non-lawyers and lawyers.

I have student loan and not good credit thank u to explain

Thanks for the great post

Thanks, it is very informative

Thanks for the great article

Thank you for the terrific post

This is truly useful, thanks.

I like the article

This is truly helpful, thanks.

Thank you for the wonderful post

I enjoy the report

Thanks, it is quite informative

Thanks for the excellent manual

I spent a lot of time to find something similar to this