Even though you don’t really have to worry about it – What happens to your assets when you die? For example who would get your condo? Your beanie baby collection? Your overpriced wardrobe?

Check out our previous blogs about why you should have a will and how your relationship status affects your partner.

Now we’re going to look into the actual process from you dying until your assests are given away.

There are two scenarios: Dying with a Will and Dying Without one.

With Will

In your will you..

- 1. Named your executor (Person in charge of your estate) and beneficiaries (people who will be getting your stuff)

While Estate Planning you also…

- 2. Made sure certain things passed outside your estate

- 3. Held title to your condo in the way you wanted.

1. Executor

You decided that your Aunt Marjorie should be the exector of your estate.

This means that she is arranging your funeral, paying your creditors, outstanding bills and your personal taxes. Yes, you owe taxes for the last year of your life. She is pretty much doing all of the boring stuff you hated doing (when you were alive).

After she pays off your debts, she gives your assets to your beneficiaries. Aunt Marjorie has the sole authority to bind your estate and follow your wishes (for example, transfer the condo into your mom’s name).

She has a fiduciary duty (a legal relationship of trust) to act in the best interest of your estate. She must keep an accounting record of everything coming and going. Lots of responsibility for Aunt Marjorie! Beware Aunt Marjorie, you can also be sued.

The good news is that Aunt Marjorie is entitled to executors compensation for all the work she is doing! Her compensation comes out of your estate.

Don’t worry. Aunt Marjorie can resign from this job if she is not up to the task. But if she started administering your esate and later decided she didn’t want to do it, she can only be removed by court order.

Estate Plan:

Made Sure Certain Assets Passed Outside Your Estate

When you die, with the proper planning, you can have certain things pass outside your “estate.” For example, life insurance policies, RRSPs, and TFSAs, can pass outside your estate to the person you named on the document to get this amount. Usually, the document to name your beneficiary is done with the bank/insurer/provider directly or with an estate planning lawyer.

Let’s say you put your boyfriend as the beneficiary of your RRSP and TFSA. That means your RRSP and TFSA have passed outside your estate and will go directly to your boyfriend. He usually gets the funds in full even though you still had a mortgage left to pay on the condo, as these are usually not subject to creditors.

Check up on your policies. Did you designate someone? If so, is that still the person you want as beneficiary? If you didn’t designate someone, then that money falls into your estate.

By falling into your estate, that money will be used to pay off your debts and your taxes. If your executor has to get a Certificate of Estate Trustee with a WIll, there may be an estate administration tax taken as well.

What is left will then be given away based on the wishes of your will. Why is it good for things to pass outside your estate? Tax savings!

2. Held title in the right way:

It gets awkward

Your mom may have gotten your “estate” – but what about your condo? You were living in a condo with your boyfriend when you died and you bought it together and jointly contributed to the bills/maintenance.

Now the plot thickens. You die.

There are two main types of joint ownership (in Ontario) for real property. These are “joint tenants” and “tenants in common”

Joint tenants

You hold your condo in joint tenancy with your boyfriend. Now you’re dead. Your boyfriend, who is still alive, gets the condo.

It is literally called “right of survivorship” – he survived, he gets the condo. The condo passes outside your estate. The condo does not form part of your estate.

Being a joint tenant means that your boyfriend now owns the condo, due to the mere fact that he survived you. Yay for your boyfriend!

Tenants in common

This is where your “share” in the condo passes down to your beneficiaries. You owned it 50% with your boyfriend, your boyfriend still owns 50% but…..

Your share passes inside the estate….and you said in your will to give your estate to your mom….

Now the condo is owned 50/50 between your mom and boyfriend. Awkward (they never got along)!

If you don’t have a will it is subject to the rules on intestacy (see below the section on Who Gets Your Assets?)

You died – you never got around to the will

Because you never had a will, there is:

1. No executor (person in charge of your estate)

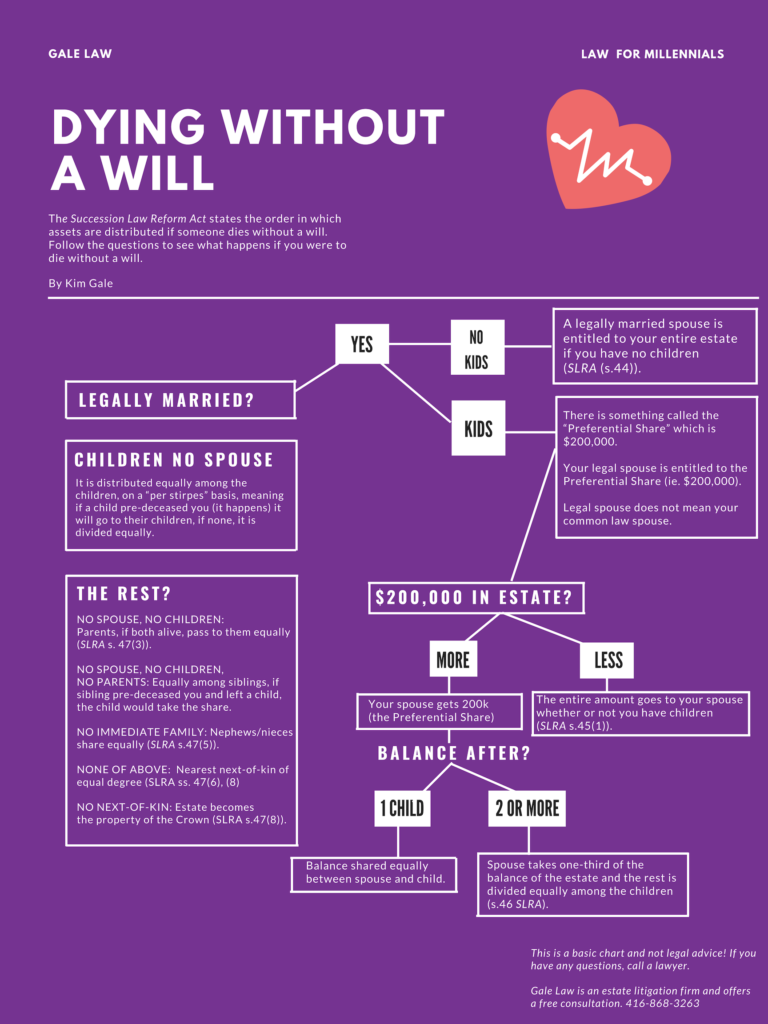

2. A statutory order of who gets your assets ( so you don’t choose who will be getting your assets, instead the law decides)

3. No opportunity to save taxes

1. Poor Aunt Marjorie

Aunt Marjorie has to put on her best dress and lipstick and go to court and apply to be your executor (if she wants to do it). Although she is the most responsible of the bunch, your boyfriend, who you were living with, has the first right to apply to be executor even if he is not good with money.

Your boyfriend must be offered this job first, even if he is not entitled to any inheritance. It is because a common law spouse is entitled to apply to be appointed as your executor first, then it is the next of kin.

If your common law spouse decides the job is not for them, next in line are your mom and dad and the your brothers and sisters. If all of these people don’t want the job and they renounce, (which is unlikely), then Aunt Marjorie gets her turn.

There is no will that can be taken to the bank, so your executor usually has to get that fancy piece of paper appointing them as executor (the Certificate of Estate Trustee Without a Will), pay the estate administration tax, and then pay your liabilities.

2. Who gets your assets?

3. Now what: your condo?

You didn’t do that whole estate planning thing and owned the condo 100% in your name, so now in addition to dealing with losing you, your boyfriend, as a common law spouse, has to lawyer up and make a claim to your estate to keep living in the place you shared together.

The moral of the story?

Get that will and estate plan done! Aunt Marjorie is clearly the best for the job. Marie Kondo your estate plan today so you don’t leave a mess!